Keeping Your Costs Down in a Retro Environment Thru Claims Management

Most people know that in Washington, a Retro program is a safety incentive program that allows employers to earn refunds on their Labor & Industries...

3 min read

Archbright Team Member

:

May 5, 2021 9:00:00 PM

Archbright Team Member

:

May 5, 2021 9:00:00 PM

In 1981 L&I started offering a voluntary Retrospective Rating program, also known as “retro.” Retro programs are safety incentive programs providing the opportunity for employers to earn refunds on L&I insurance premiums as a reward for creating safe work environments. Archbright began sponsoring its first retro program in 1985 and manages the largest and one of the highest performing retro groups for manufacturing companies in the state of Washington. In the over 35-year history of our manufacturing retro program, we have never received an assessment.

Several organizations sponsor retro groups, and it can be daunting for employers when choosing which group to join. There are many factors to consider. In the below excerpt from our White Paper: The Case for a Bigger Retro Program, we describe the importance of group size and how the group allocates the refund to its members.

Possibly one of the most significant considerations when joining a group is how much premium is already in the group from other members. Group size can significantly impact the refund that each participating member receives.

According to L&I, “Groups typically have better refund potential because they have a larger premium total. Retro is premium sensitive, meaning the larger the premium, the greater the percentage refund for a given amount of risk.”

How does this boil down to member refunds? L&I has a set amount of money to be rebated to all retro programs state-wide. Given similar plan choices and performance, a group with more premium will always get a larger return.

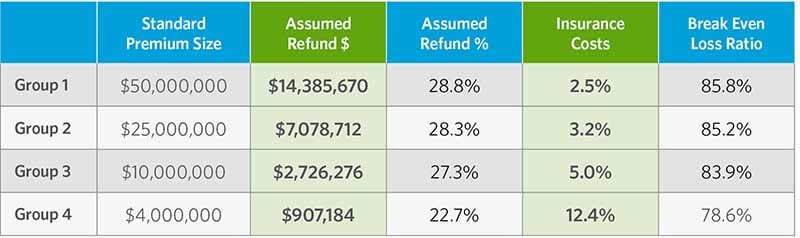

The example chart below assumes the same plan choices with all groups having a 60% claim loss.

Looking closer at the chart, the first thing that you may notice is that Group 1 has the largest refund amount in this scenario. The refund percentage is higher for the larger group, but of note, in addition to more money being returned, the insurance costs are lower for the larger group. Therefore, the larger group is starting with fewer program costs than the smaller program.

Insurance costs are applied by L&I based on your size and your plan choices. They act like losses in your plan year, so it is advantageous to have the lowest insurance costs possible.

The break-even loss ratio (BELR) is the point at which a group switches from a refund to an assessment by comparing the developed claims costs to the standard premiums. If the developed claims cost percentage exceeds the BELR, the group will receive an assessment. The BELR is determined by both group size and plan selection. The chart shows that if all groups had the same plan choice and developed claim’s loss percentage, it would be harder for a larger group to receive an assessment than it would be for a smaller group.

Of the last fifteen retro groups in the state to receive a final assessment, only one group was over $25 million in standard premium. The average size of the groups being assessed was $11 million in standard premium. Larger premium based groups have more money to cover costs making it less likely to receive an assessment, even in an especially poor group performance year. The larger the group, the lower the risk.

So, where does the money go? It is easy to focus on refund percentages when comparing groups. Many groups will advertise based solely on their refund percentage, yet this does not paint the whole picture. Other factors that impact how much money an employer will be refunded are the size of the group and how the group allocates the refund to its members.

If a group touts that they received a 25% return, what is the total premium that 25% is based on? Is it 25% of $1 million, or is it 25% of $10 million? And to how many members is that return being distributed? Does the group take their fees out of that return? Does every member get part of that return, or is it only shared with positive performing participants?

As you can see, we need to dig further to truly understand how much money is returned to member’s pockets. Make sure you have the answers to these questions before you join any program.

One of the biggest advantages of Archbright’s retro program is the size of the program. Archbright’s manufacturing program is the largest in the state, with over $50 million of standard group premiums.

Equally as important, Archbright does not keep any of the refunds. All monies returned to the group are distributed to members based on merit, meaning only those that had positive performance years receive a refund.

Statistically, all companies will have an adverse claims year at some point, and Archbright believes that they should not be penalized. Instead of paying a fee for a poor performance year, a member that does not qualify for a rebate pays no additional penalties. The whole point of joining a group program is to share the risk and avoid paying an assessment.

Archbright closely monitors each member’s performance and continually offers support to identify trends, reduce injuries, and aggressively manage claims. If a member is struggling with their claims for whatever reason, the Archbright team is there to support them and will develop a custom plan to get them back on track.

For additional information on our manufacturing retro program, read our entire White Paper: The Case for a Bigger Retro Program. It lays out the benefits of not only joining a manufacturing retro program but why joining a large retro program in Washington State could help your organization lower upfront costs as well as increase the amount of workers’ compensation insurance premiums being returned to your business. The less money you spend, the more you can invest in your business and your most important asset, your people.

Most people know that in Washington, a Retro program is a safety incentive program that allows employers to earn refunds on their Labor & Industries...

Now, more than ever, Washington businesses are ‘feeling the pinch.’ Revenue margins are slimming while expectations from both internal and external...

In 2012, Washington’s Department of Labor and Industries initiated a formal Stay at Work program to incentivize employers to utilize light-duty...